Seeing is Understanding

In October, I had the privilege of facilitating the Foundation’s Workshop in conjunction with GECU in El Paso, TX, a vibrant, dynamic, safe city that is more than 80% Hispanic and the largest Borderplex town in the United States.

100+ credit union professionals from around the country joined us for a deep dive on how credit unions are identifying and meeting the needs of Hispanic members and communities, and the steps all credit unions can take to better serve a growing multicultural membership base.

Attendees experienced El Paso in all its glory – from the incredible food, to the nonprofits who are serving the immigrant community, to one of the best minor-league (the Chihuahuas) stadiums in the country where we listened to mariachi music and got a private, VIP tour of the stadium.

What struck me most from the week is that seeing is understanding. Attendees saw a former senior border patrol agent Michael DeBruhl, talk factually about who is coming across the border and what is happening. Mr. DeBruhl now serves as Director of the Casa de Sagrada Corazón, the first stop for immigrants coming to this country from across the border. Attendees had the chance to visit Sagrada Corazón and see firsthand the needs and opportunity to serve people seeking a better life here in the U.S (United States).

Similarly, attendees saw and heard from Victor Corro and Dr. Jennifer Esperanza of Coopera Consulting, LLC. Victor and Jennifer shared their own stories as well as their insights and expertise on the opportunity for credit unions to leverage the increasing multiculturalism of members for future growth and sustainability.

Jennifer laid out the importance of storytelling. “Stories can make complex information more relatable, forge connections with your members through empathy, unite staff towards a shared purpose, and drive long-term membership and growth,” she noted. “Words matter,” she continued. “The language of ‘surge, invasion, swarm and flood’ is strongly linked to the dangerous migrants as a ‘threat.’ These words evoke ideas of a war against an enemy ‘Other’ or imagery an uncontrollable invasion of insects or animals. By placing the blame on people seeking safety and minimizing their trauma or suffering, it also gives the false impression that the host country would be ‘overwhelmed’ by the presence of migrant communities.

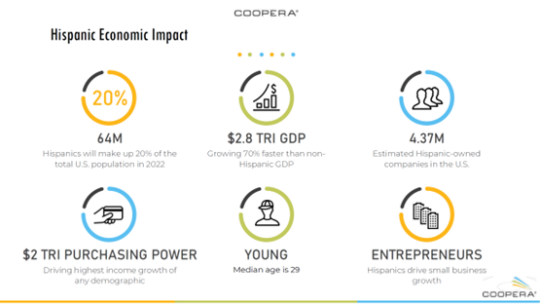

Victor focused the conversation on acculturation and the opportunity for credit unions to serve the growing multiculturalism of their members. He shared this slide:

Seeing is understanding. As credit unions look for ways to diversify and grow members, this is that opportunity. Pablo DeFilippi of Inclusiv brought this point home as he discussed the Juntos Avanzamos designation and the opportunity for credit unions to deeply commit to serving an increasingly multicultural America.

Attendees discussed the barriers and opportunities to better serve Hispanic members in their communities. Ideating and sharing resulted in these clear action steps all credit unions can take:

- Know your member is not just for BSA (Bank Secrecy Act). Get to know your members and employees to embrace our unique cultural distinctions. There is strength in diversity.

- Partner with local non-profit organizations in your community that are serving communities that may be traditionally unbanked or underbanked.

- Review your products and solutions portfolio to ensure that your credit union’s offerings meet the needs of your current and future members.

- Identify how your credit union organization can begin to accept foreign passports and consular identification cards for account openings.

Take a look — a deep look at your membership. What are the demographics? What are the financial needs of different segments of your membership? Are you providing accessible, affordable, and appropriate financial products, services, coaching to those different demographics – literally, meeting them where they are in their financial lives? That is the opportunity to future proof credit unions long into the future.

Tobi Weingart, Chief Program Officer