Grants

Catalytic grants to make an impact in your credit union and local communities.

Recent grant reports

-

Pelican State Credit Union’s Financial Wellness Program

This grant helped document the impact of Pelican State Credit Union’s financial well-being program from 2019 to 2021 – the height of the COVID-19 pandemic.

-

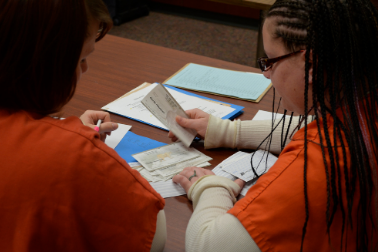

Royal Credit Union's Incarcerated Individual's Education

A National Credit Union Foundation grant helped Royal Credit Union secure greater measurement and analysis of their financial education for incarcerated individuals program.

-

Know Your Membership with Attune and Coopera Consulting

An active grant supporting seven small credit unions to better understand their membership is uncovering critical opportunities to help credit unions stay relevant.

Get in touch

For more information on the Foundation’s grant program

Contact Christine Hickey, Financial Health Program Senior Manager

Christine manages the Foundation’s day-to-day financial well-being efforts, supporting the collaborative CU system efforts to grow the FinHealth Fund work, executing grants program administration, and leading the success of the CU FinHealth Conference.