The Foundation Gala Presenting the Herb Wegner Memorial Awards

About the Foundation Gala

The Foundation Gala is our primary fundraising event. The generosity and support of attendees and sponsors directly affects our ability to improve financial well-being with and through credit unions.

A mainstay of the annual gala is the Herb Wegner Memorial Awards ceremony—the credit union movement’s highest national honors.

The Foundation Gala is held in conjunction with America’s Credit Unions Governmental Affairs Conference and will take place:

Monday, March 2nd at 6:30 PM

Marriot Marquis Ballroom, 901 Massachusetts Ave. NW

Black tie optional

A general reception with a cash bar will begin at 5:30 PM in the foyer of the Marquis Ballroom. Seating will begin at 6:00 PM and the dinner program will begin at 6:30 PM.

Tickets and sponsorships are available here.

Nominations

The awards were established to honor the memory of Herb Wegner, a visionary leader who served as President & CEO of CUNA in the 1970s who is noted for seeing the credit union movement not as it was but how it could be.

The National Credit Union Foundation is proud to host these awards, the credit union movement’s highest national honors.

The nomination period for the 2026 awards are now closed!

Questions? Contact Jenni Speth at [email protected].

2026 Herb Wegner Memorial Award winners

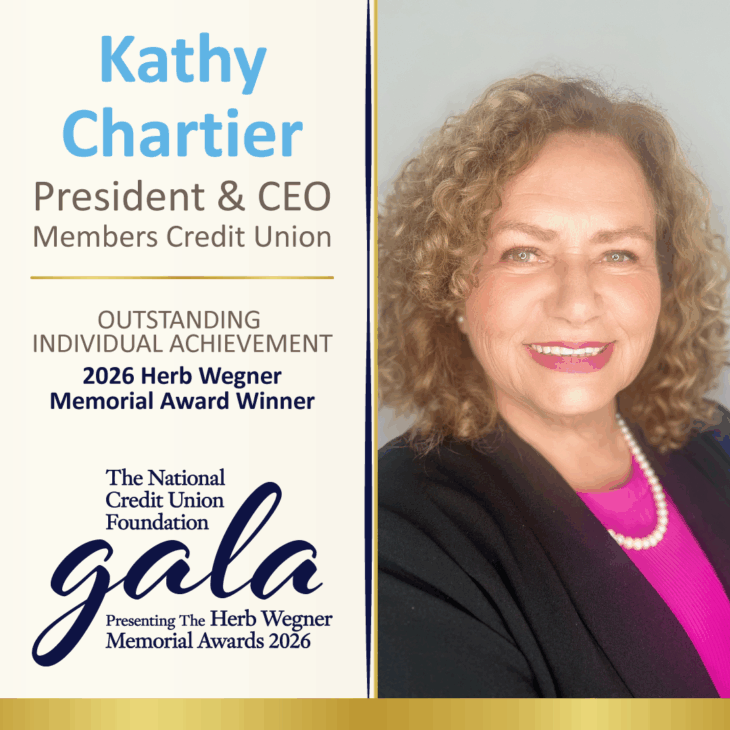

Kathy Chartier

“Kathy didn’t just build a financial institution-she built a community catalyst.” – Vanessa Kuduk, VP of Lending, Members Credit Union

Fairfield County, Connecticut, is one of the most affluent counties in the United States, and, as a result, its residents reckon with some of the highest levels of income inequality. Kathy Chartier, President/CEO of Members Credit Union, headquartered in Stamford, chose to face that dichotomy head-on.

While the teachers Members Credit Union (originally called Greenwich CT Teachers FCU) served were earning a living wage, Kathy recognized that the people supporting the schools – including bus drivers, staff, and nutrition workers, many of whom were immigrants – struggled to make ends meet. In response, she and her team worked to expand the credit union’s charter and launch a plan to address the needs of the diverse and underserved communities in her area.

Members Credit Union boldly redefined its mission, expanding its charter to serve all of Fairfield County – not for profit, but to transform into a community-focused cooperative that serves everyone, especially those of modest means, offering access, dignity, and empowerment.

Click here to read more.

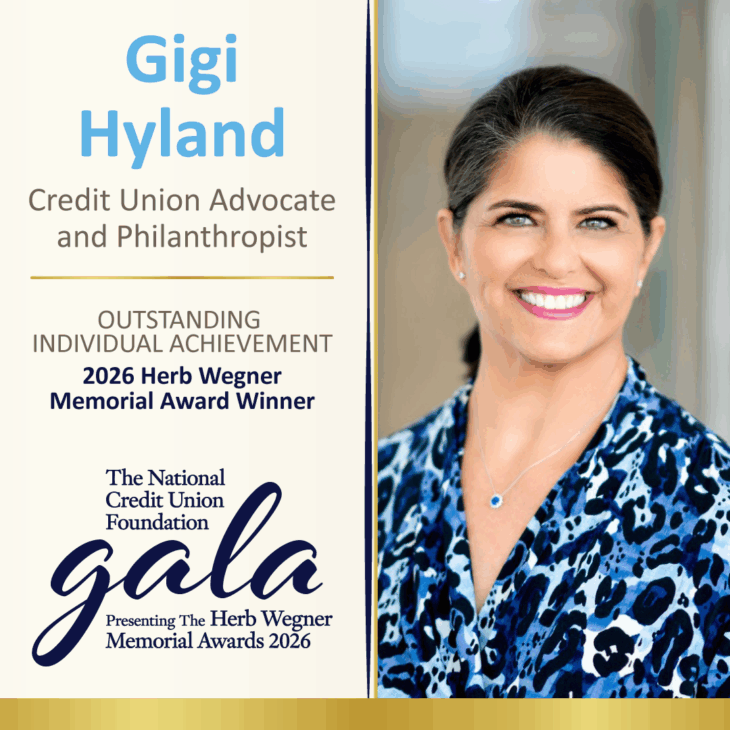

Gigi Hyland

“There are leaders who manage. There are leaders who inspire. And then there are the rare few who do both – with grace, vision, and fierce determination. Gigi is one of those few.” – Tobi Weingart, SVP Member & Industry Engagement, The League of Credit Unions & Affiliates

As credit union professionals, we have the good fortune to work with people every day that are passionate about our movement and the impact they have on the people they serve. How often is it, though, that we encounter someone that has impacted generations of credit union members, even if they will never know it?

Gigi Hyland is a credit union legend of that magnitude.

She will likely say, and it is true, that an ideal as all-encompassing as “Financial Well-being for All” doesn’t gain traction on the national stage without the support of thousands of fierce advocates from credit unions across the country. But without her leadership at the National Credit Union Foundation, her care, her compassion, and her staunch belief in doing what is right, it may have never reached the ears willing to hear it, the teams ready to implement it as a strategic pillar, or the many hands eager to lift up those they have not been serving.

Jennifer Tescher, Founder & CEO of the Financial Health Network, reflects: “I engage with a wide range of financial services companies and leaders around the globe. From that perspective, I can say without hesitation that the U.S. credit union movement is far ahead of the pack in its adoption of a financial well-being approach. I am also confident that it would not have happened without the fearless leadership of Gigi Hyland.”

Click here to read more.

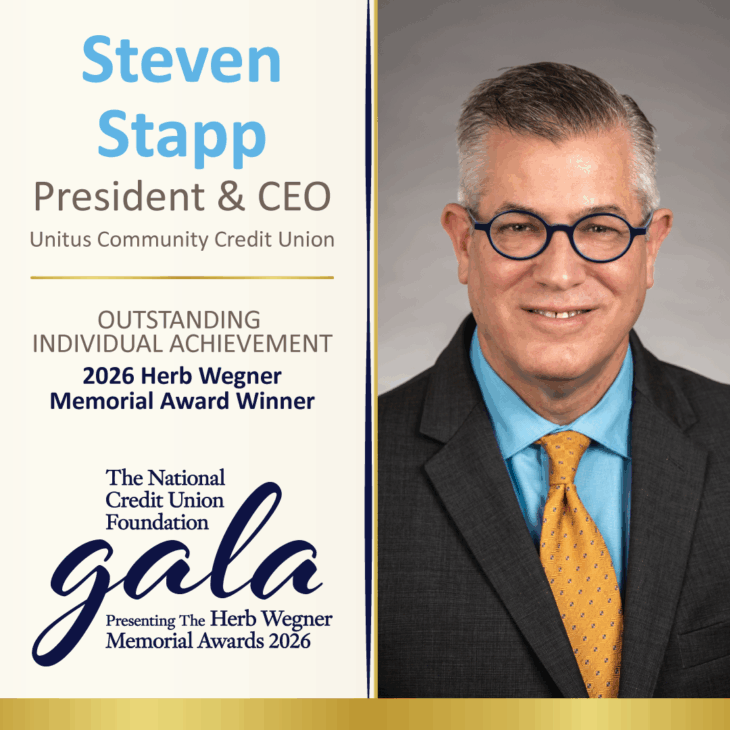

Steven Stapp

“Cooperation, inclusion, concern for community – Steven brings every cooperative principle to life, not only through what he leads, but how he leads.” – Susan Mitchell, CEO, Mitchell, Stankovic & Associates

Since the beginning of his credit union career, Steven Stapp has pioneered models of Diversity, Equity, Inclusion, and Access that have become the standard for the credit union movement. As the SVP of Branches, he led Golden 1 CU to be the first in California to accept the Matricula Consular ID card, blazing the path for credit unions across the United States to reach more members in desperate need of financial support.

Steven didn’t stop there. He has risen to meet the challenges of diverse organizations, helping them expand their visions and ability to serve the underserved. At Unitus Community Credit Union, where he has served as CEO since 2016, he has led the launch of Individual Taxpayer Identification Number (ITIN) lending, implemented bilingual digital tools, and championed programs that help families stop living paycheck to paycheck, save for emergencies, and begin to build generational wealth. Under his leadership, Unitus has become a national model for inclusive, people-first credit union service.

Click here to read more.

2025

Maine Credit Unions’ Campaign for Ending Hunger – Maine

2024

Selfreliance Foundation – Illinois

2023

2022

Faith Based Credit Union Alliance – Illinois

2020

Maurice R. Smith – North Carolina

2019

Crystal Long – Texas

Nusenda Credit Union Foundation – New Mexico

Bill Hampel – District of Columbia

Past WinnersSponsors

We are excited to gather for our 37th annual National Credit Union Foundation Gala Presenting the Herb Wegner Memorial Awards. This evening is dedicated to celebrating the achievements and impact our peers have made on our movement.

We also celebrate you. Your attendance at our annual fundraising gala allows your Foundation to improve financial well-being with and through credit unions.

Champion Sponsors

Impact Sponsor

Catalyst Sponsor

Visionary Sponsor

Hero Sponsors

Crasher Table Sponsors

Past Award Winner Table Sponsor

Small Credit Union Table Sponsor

Philanthropist Sponsors

AACUC • AACUL • Acumen Financial Advantage • America’s Credit Unions • America’s Credit Unions Councils • Ascend FCU • BECU • Blaze CU • California’s Credit Unions & Nevada’s Credit Unions • CapEd CU • Community First CU • Congressional FCU • Connecticut’s CUs • Cornerstone Foundation • Corporate One FCU • Credit Union Impact Foundation • Credit Union of Southern California • CUES • Empower FCU • First Tech FCU • FIS • GECU • Gesa CU • GoWest Credit Union Association • GreenPath • Illinois Credit Union League & Envisant • Jack Henry • Lake Michigan CU • Metro CU • Michigan CU League • Minnesota Credit Union Network • NASCUS • Nusenda CU • Orsa CU • Premier America CU • Randolph-Brooks FCU • Royal CU • Visions FCU • Wisconsin Credit Union League

Herb Wegner Memorial Awards

The Herb Wegner Memorial Awards were established in 1988 to honor the memory of Herbert G. Wegner. The National Credit Union Foundation is proud to recognize leaders, programs and organizations that, like Herb Wegner, make a lasting impact on the credit union movement.

Testimonials

Linda Armyn, President & CEO, FourLeaf FCUThe Foundation Gala demonstrates how as an industry credit unions are intentional about being at the center of the communities we serve. Credit unions are making impactful contributions to communities across the globe everyday. The awards dinner amplifies that while we may all be leading our own incredible efforts, together we are a part of a movement that makes a difference for all.

Get in touch

For more information on the Foundation Gala

Contact Jennifer Speth, Engagement Director

Photo/Video/Recording Release

The Foundation, itself or by its contractors, may be photographing, videotaping, audio-taping or webcasting sessions and events at its events. By attending, participants acknowledge these activities and agree to allow their image and/or voice to be used by the Foundation, such as in publications, on the Foundations’ website and in marketing and promotional materials, without compensation.