Implement an incarcerated individual financial well-being program in seven steps

The National Credit Union Foundation partnered with Royal Credit Union (Wis.) to develop this How-To guide for credit unions looking to start financial wellness and education programs in prisons, jails and correctional facilities.

1. Be present in the community

These relationships are built on trust. Trust between the credit union and the institution; trust between program participants and the counselors. Having a mature community engagement strategy will open doors.

2. Take a chance, reach out

Regardless of incarceration, with over two-thirds of people in America considered financially unhealthy, programs are needed. Reach out to prisons and jails directly with a proposal – you may be surprised how open they are.

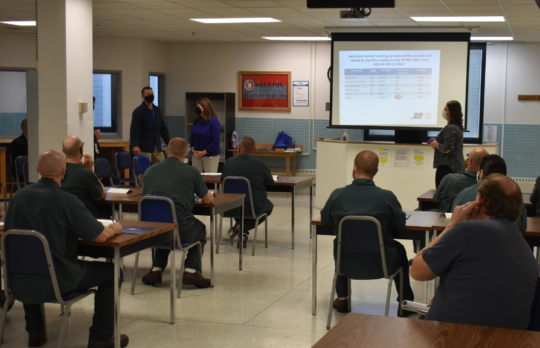

3. Develop an adaptable curriculum

Financial services evolve, your curriculum should, too. Rather than invest in developing a broad curriculum, focus on core financial tenets:

- Cash Flow: income, saving, budgeting

- Credit: understanding values, understanding risks

4. Embrace and understand discomfort

On entering a restricted area, you are no longer in control. Learn the rules, understand the expectations and prepare yourself for the environment.

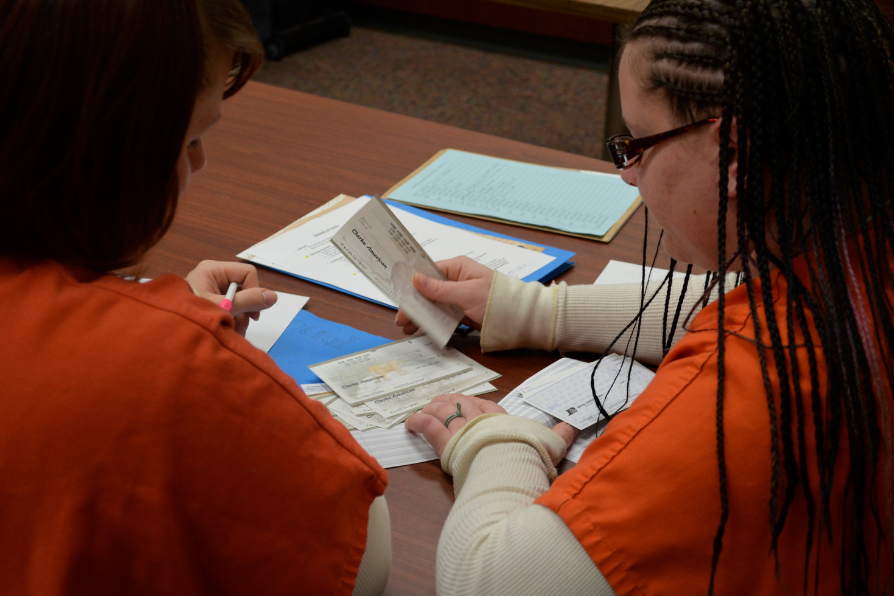

5. Know your audience

Are you working with people about to re-enter the community or people about to start a long prison sentence? While the educational elements may be the same for both, the practical examples and reasoning should adapt.

6. Measure your progress

Develop a knowledge test and track participants’ progress over time. This will help you refine your curriculum, provide the most value to participants, and demonstrate impact to the institution and credit union leadership.

7. Know where your program starts and ends

Measurement is everything… most of the time. Privacy laws complicate or restrict tracking at the best of times, but it is more complex when working with incarcerated individuals.

For more information: Download a printable version of this resource with additional information.