Financial Well-being for All

Help your credit union grow, members and employees thrive, and communities prosper.

Living the credit union difference

Credit unions were established to ensure everyone had access to safe, affordable financial services. Almost a century later, the need is as great as ever. Credit unions can thrive by meeting members where they are in their individual financial journey, with the right solutions at the right time. That is our mission.

When mission meets moment

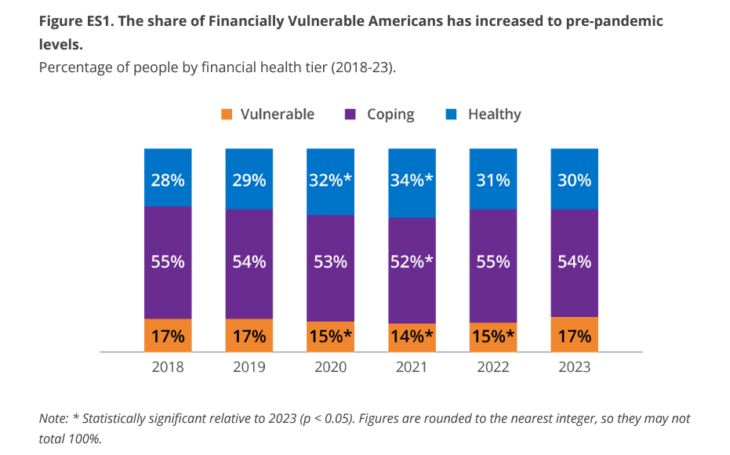

Over 43 million people are financially vulnerable, and the wealth gap is widening. The share of Financially Vulnerable Americans grew to 17% in 2023 from 15% in 2022. Black, Latinx, and younger Americans disproportionately experienced an increase in financial vulnerability

Credit unions were established to provide safe, affordable, and relevant financial products to the underserved and overlooked.

FinHealth Network, Financial Health Pulse 2023 Trends Report. View the full report HERE.

Financial well-being for all Quick Start Guide

In partnership with Filene, the Foundation has produced a Financial Well-being for All Quick Start Guide.

This document uses the four-step framework below to provide data, examples and inspiration that can support your organization’s financial health strategy, wherever you are on your own strategic journey.

Resources

We have the research, how-tos, case studies and more to help your organization implement or enhance a financial well-being strategy, and your members achieve financial freedom.