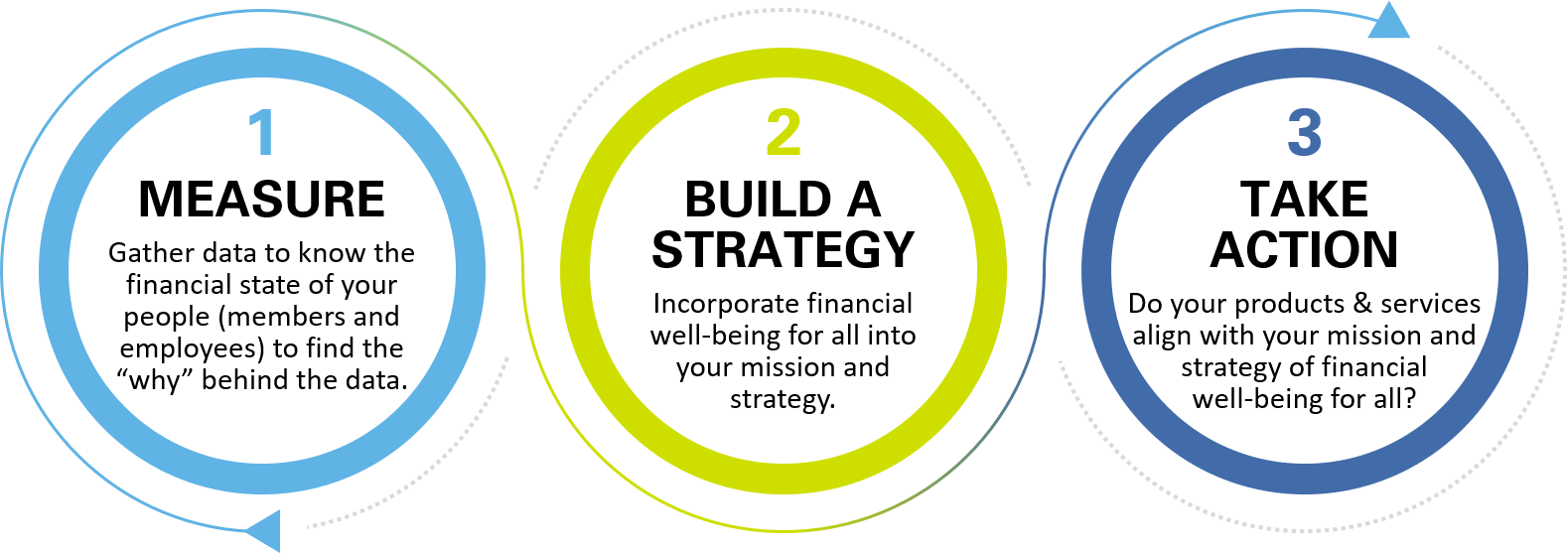

Take Action: Build Your Strategy

Explore examples to spark ideas and evaluate your strategy to improve financial well-being for all.

![]() Improving financial well-being for all is not one size fits all. Every credit union is different, every member’s situation is unique. What one credit union is doing may or may not be right for another credit union to do or try. But, credit unions need to demonstrably show that work through proof – stories, numbers, data that shows all the good work credit unions do to improve financial well-being for all. The point is to start.

Improving financial well-being for all is not one size fits all. Every credit union is different, every member’s situation is unique. What one credit union is doing may or may not be right for another credit union to do or try. But, credit unions need to demonstrably show that work through proof – stories, numbers, data that shows all the good work credit unions do to improve financial well-being for all. The point is to start.

Getting started

Ideas into action

Take the time to really understand what your members’ financial lives are like. Stand in your member’s shoes, just for a moment. Once you understand what their challenges are, prioritize what you want to tackle, then build from there. To help spark ideas and help you build out your strategy to improve financial well-being for all, browse through the tabs for examples from others that we hope you can learn from:

Leveraging pathways to improve employee financial well-being

University Federal Credit Union started at home by measuring employee financial well-being and worked to improve it through financial coaching.

Starting each new member relationship with a financial health check

Building upon previous measurement work and findings, Coastal Credit Union now measures every new member to evaluate their financial well-being.

Measuring & using transaction data

BECU partnered with ideas42 to pilot the Financial Health Check to track transaction data to better meet members where they are in life.

Measurement matters in improving financial health

Financial Health Network, PSCU and Members Development Company partnered to measure the financial health of members and employees.

Mission moments at board meetings

Learn from Patelco Credit Union who starts their board meetings with achievement of mission through mission moments & products.

What we say about ourselves

Allegacy Federal Credit Union puts its mission and true north star first and foremost on their website.

Emergency relief grants

Aliza Gutman from Canary shares the opportunity for credit unions to put mission into practice through emergency relief grants.

Side Effects: the link between health & wealth

A multi-media project exploring the financial crisis of cancer hiding in plain sight and the implications it has on people’s physical and financial health.

Out of the box partnerships in your community

Royal Credit Union partnered with local correctional facilities to provide financial education and training to incarcerated persons.

Using CRM to track financial counseling results for members

San Mateo Credit Union uses their CRM system to track the impact of their counseling program on members’ savings goals, attitudes and behaviors.

Removing barriers in the community to meet members where they are

The VyStar@Work Program helps people in their community join the credit union and puts them on a path to financial well-being.

QCash – a Payday lending alternative

Learn more about QCash Financial, a CUSO of WSECU commercializing small dollar loans.

Embedding financial wellness into digital banking

Alkami Technology helps credit unions to embed financial wellness into digital banking to help both members and credit unions in the long run.

"All in" mentality

This is an “all in” venture. This needs to be across the credit union – not just the community engagement team or HR or the CEO — it’s everyone and integrated into everything you do. It is our driving purpose.

We are all in this together: credit unions big and small, CEOs, volunteers, co-workers, leagues, foundations, and system partners. Those already on the journey and those who are just getting started. Join us on the journey to making financial well-being for all a reality.

Explore how to enhance your strategy

Now that you’ve determined how you want to integrate financial well-being into your organization’s strategy, we have some additional ways you can connect your mission to the needs of your community.