Side Effects™: Act 1 | The Car Crash in the Living Room

It’s easy to reduce cancer to numbers:

- At some point in their lives, 40% of all Americans will be diagnosed with cancer, the second-leading cause of death in the United States.

- Within 30 days of diagnosis, the vast majority of cancer patients will hit their annual out-of-pocket maximum – $8,550 for an individual and $17,100 for a family plan offered in 2021 on HealthCare.gov.

- Because of the sudden and massive financial stress, patients battling cancer are 2.65 times more likely to declare bankruptcy.

- When they do, their risk of early mortality skyrockets 79%.

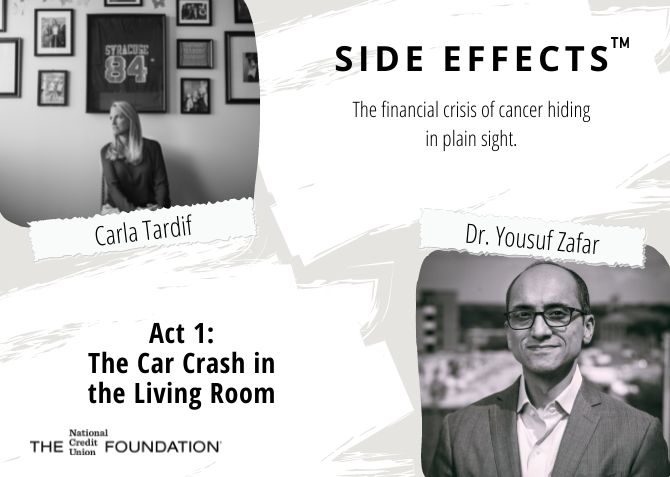

Cancer researchers like Dr. Yousuf Zafar from Duke University and patient care advocates like Carla Tardif from Family Reach offer these numbers early and often in discussions about the cost of cancer in America. They call the financial impact of cancer a crisis, and it is.

Cancer researchers like Dr. Yousuf Zafar from Duke University and patient care advocates like Carla Tardif from Family Reach offer these numbers early and often in discussions about the cost of cancer in America. They call the financial impact of cancer a crisis, and it is.

They say that there is an opportunity for the financial services industry and healthcare to come together to treat patients battling cancer, and we should.

The problem with numbers, especially for credit unions, is that they quickly become abstractions to calculate and manipulate, to the point where the human toll is overlooked and minimized, so let’s try this:

The $17,100 annual out-of-pocket maximum for a family plan is, according to Carvana, the current retail price of a 2018 Chevrolet Equinox.

The $17,100 annual out-of-pocket maximum for a family plan is, according to Carvana, the current retail price of a 2018 Chevrolet Equinox.

The physical and psychological devastation of cancer is like that Chevy careening full-speed into your living room, annihilating your furniture and keepsakes and memories, before sputtering to a halt in the middle of what used to be your safe and secure home. Everything is broken. Nothing will be the same.

The financial devastation is the same as paying the entire retail price of that life-threatening missile out of your own pocket.

Worse, the out-of-pocket maximums reset on January 1. If you were diagnosed in December and your treatment continues into the next year, your medical debt doubled in a month.

That’s like another Chevy landing on top of the first one in your living room. Now you must pay the retail price for that second car, in full, and out of what little remains in your pocket.

No one can tell you when either car will be cleared from your living room. No one knows when your home will be fixed. You don’t know if another Chevy is careening toward you.

But the real gut-wrenching battle has just begun – the battle to preserve your financial and physical health, both of which are more intimately intermingled than previously realized.

It’s a battle that we simply don’t talk about in this country because of how personal and painful it quickly becomes for patients and their families.

They don’t want to tell you about the savings and retirement plans they drained and the credit cards they maxed out to meet deductibles, pay for prescriptions, buy a meal at the hospital, or put gas in their car to get back and forth to chemo.

They don’t want to talk about the GoFundMe that was launched in their name but failed like nearly all do; the average cancer-related GoFundMe sets a goal of $20,000 but raises only about $5,000.

They break down when they admit they’re months behind on mortgage and car payments, days away from having their overdue electricity shut off, exhausted from another sleepless night from post-chemo nausea, yet still mustering the strength to get to work because they can’t afford to lose the job that provides their medical insurance.

They’re shocked when their bank or credit union tells them there are no assistance programs available to temporarily ease the burden of their overdue loans.

They’re embarrassed when that same institution chides them for not putting more aside to prepare for emergencies like this one and coldly lectures them about how they’re still responsible for the payments.

They mourn the life they knew while trying to feed, clothe, and protect the people they still live for now.

They mourn the life they knew while trying to feed, clothe, and protect the people they still live for now.

It is a mathematical certainty that in America, the richest and most advanced country in human history, someone where you live, work, or worship is suffering in silence like this right now.

But there is a bright spot – us.

We can help these suffering members by first acknowledging the link between financial and physical health.

This hopeful, healing work is happening in our industry right now, but much more is needed.

That’s why the Foundation is going beyond the numbers to tell the stories of real people who have endured the car crash of cancer.

By pulling this crisis out of the shadows and into the light, it is the Foundation’s hope that, through our cooperative spirit and collective talent, credit unions can heal the financial wounds of cancer so our members don’t have to choose between their money and their lives.