A Deeper Dive into Financial Well-Being, & Why It’s At Core of One CU’s Strategy

Story originally shared on CUtoday.

WASHINGTON–The role credit unions can play in creating financial well-being was a priority during CUNA’s GAC, and four people took a deeper dive into the issue, sharing national findings, one CU’s specific strategies, and how the subject dovetails with CU advocacy.

During a breakout session, Gigi Hyland, executive director of the National Credit Union Foundation, moderated a discussion that included Taylor Nelms, senior director of research with the Filene Research Institute; Todd Marksberry, president and CEO of Canvas Credit Union in Colorado; and Dan Schline, president and CEO of the Carolinas Credit Union League.

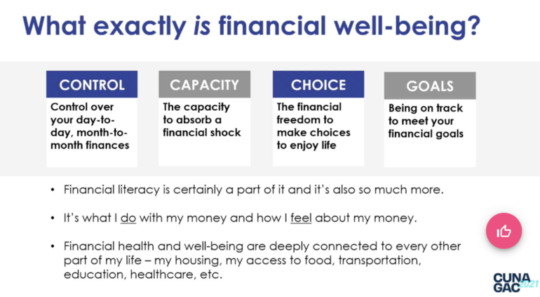

Prior to the Q&A, Hyland shared several graphics related to financial well-being, including a definition of financial well-being itself (see slide).

“I want to be clear that financial literacy is not necessarily financial well-being,” said Hyland.

“Financial literacy is a part of financial well-being. Financial well-being is a combination of what you do, what your personal financial situation is, and how you feel. Financial health and well-being are deeply connected to every other aspect of life: housing, access to food, transportation, healthcare.”

The numbers that “bring it home,” said Hyland, can be seen below.

Below is a look at some of the Q&A:

Hyland: Filene has this Center on Financial Lives in Transition. Tell us about that work generally, and specifically, what are you seeing almost a year into the pandemic and where the opportunities are for now?

Nelms: Financial well-being is central to the credit union value proposition. Let me start with some context. What we have found is entering into 2020 we were in the middle of a historically long period of economic growth as a country, but at the same times the signs of economic distress were right there under the surface. For the vast majority of non-wealth Americans, many were really caught in middle between non-rising wages and rising expenses. Pre-pandemic, we saw growing consumer debt burdens. The pandemic has intensified those trends and exacerbated the disconnect between what our economy looks like on paper and what people are experiencing.

What does it all mean for financial services and credit unions? In the last year Filene has stood up five consumer centers (to examine those issues).

In our Incubator, we pilot test and scale new products and business models to reduce the front-end risks for credit unions and their members.

We have also launched a new custom research project to measure holistically the financial well-being of members.

From all of that we have four big takeaways:

- Financial well-being needs are increasingly driving the need for financial services and the search for financial security.

- Financial well-being is connected to overall wellness.

- Financial well-being is complex. Simply providing access is not enough. Cost and delivery also matters.

- Financial education by itself is not enough. Much of what shapes are well-being is beyond our financial control.

We know that financial well-being is not an all or nothing proposition. People are piecing together complex financial support systems. They fall into and out of financial wellbeing. Life changes can really profoundly affect well-being.

Nelms: Financial well-being is central to the credit union value proposition. Let me start with some context. What we have found is entering into 2020 we were in the middle of a historically long period of economic growth as a country, but at the same times the signs of economic distress were right there under the surface. For the vast majority of non-wealth Americans, many were really caught in middle between non-rising wages and rising expenses. Pre-pandemic, we saw growing consumer debt burdens. The pandemic has intensified those trends and exacerbated the disconnect between what our economy looks like on paper and what people are experiencing.

What does it all mean for financial services and credit unions? In the last year Filene has stood up five consumer centers (to examine those issues).

In our Incubator, we pilot test and scale new products and business models to reduce the front-end risks for credit unions and their members.

We have also launched a new custom research project to measure holistically the financial well-being of members.

From all of that we have four big takeaways:

- Financial well-being needs are increasingly driving the need for financial services and the search for financial security.

- Financial well-being is connected to overall wellness.

- Financial well-being is complex. Simply providing access is not enough. Cost and delivery also matters.

- Financial education by itself is not enough. Much of what shapes are well-being is beyond our financial control.

We know that financial well-being is not an all or nothing proposition. People are piecing together complex financial support systems. They fall into and out of financial wellbeing. Life changes can really profoundly affect well-being.

Hyland: What does this look like at a credit union?

Marksberry: For what we’re doing I have to give some context. I had the opportunity to be asked to lead this credit union five-and-a-half years ago. When I first got here we set a bold vision with our strategic pillars about how we serve our members and communities. We decided we were going to work very hard to be a household name known in our communities for our people and our heart.

What I figured out very quickly is as you begin to work on that you find you have a whole bunch of things you have to work on. Loan systems. Employee retention. You cast this vision with good intentions, and you have a lot of things to do. We worked on that fir the first couple of years.

Three years ago we rebranded after being Public Service Credit Union to Canvas. At that time it gave us the opportunity to look out and cast a very bold vision in terms of how we could better serve our members. We had done a good job in terms of the awareness, but we knew that we really had to move from awareness to loyalty. There were a whole lot of things in between, and one is a concept from Mike Mercer (formerly of the Georgia CU League) about helping our members afford life. At the time we rebranded, we said we’re going to help members afford life so they can go live.

We had to answer the question for members and prospective members, ‘What’s in it for me?’ We’ve always had a commitment to financial well-being, but we really wanted to take it to the next level. We realized we had to be more than just a place to get a car loan. We had to focus on the other components of social, health and financial. So we partnered with Filene and have a research project around the idea that if we could work towards helping our members be more well and make that connection, that we could probably bring our members from awareness and single service to deep, deep relationships with us, and our community in Colorado would view us in this different light.

Filene did survey of little more than 7,000 members and non-members. Interestingly, what we found in comparing members non-members, the things we had been doing over the last three years with our members in the categories of social, health and financial had made our members more well than people who weren’t members of Canvas CU. We had to put that research into action and bake that into our efforts.

We’ve always been committed to financial well-being, but we also now promote to our members what we are doing in the community and how they can be a part of that, what we’re doing in the health part of it, and we are helping them to understand how these are all connected.

If you feel very good about your financial well-being it trickles over into these other areas. We feel we have to rise above the noise. There are lots of providers who are doing good things. Those are table stakes. We really need to connect with our members and our communities in helping them to afford life.

Hyland: Dive a little deeper into what Canvas is doing. Every CU has financial literacy. It feels like the rebranding has really changed how you interact with members.

Marksberry: We’ve taken all that information and what we’ve learned with Filene and we’ve begun to build out a strategy internally and externally. With 625 team members, we have focused very much on starting with our team. We care very deeply about what they’re doing with their finances. We have a lot of programs with loan discounts and financial education. We also have a lot of programs where we focus socially speaking in terms of what we are doing in the community and what shows the heart of Canvas.

We give them an enormous amount of time on the company’s dime to engage in the community. We hired a wellness champion, a new position, who works for us and her sole responsibility is to partner with our 625 Campus family members and to track that and to help them.

The strategy now is to take what we’re doing internally and work with our members externally. It sounds simple, but I don’t think credit unions really do it.

We believe strongly we can help members afford life. We are going to dedicate a 30 second Super Bowl commercial to our wellness program. We are going to dive much deeper into this.

Hyland: Let’s pivot to advocacy. We’re talking about importance of financial well-being for all. What is your lens on how you see financial well-being fitting into the advocacy?

Schline: Thera are a variety of reasons why I think this topic of financial well-being is important to advocacy work.

The charge from Congress to credit unions is to promote thrift and create a source of credit for productive and provident purposes. What we’re talking about is helping members save and borrow in a way that promotes financial well-being. We have all these system partners and we’re all thinking about this issue and what are the problems members need help with.

For a credit union, financial well-being is those moments in time where the credit union can step in, meet that need and help that member along the way. It’s not a destination or an event, it’s a journey.

I think it’s important we really think about, ‘Is the work we do on a daily basis consistent with the work we are supposed to be doing? Are we delivering on this charge Congress has given us? How do we put this at the center of our value proposition?’

The second piece, I think, is a bit more practical from the advocacy standpoint and that is how are we doing in telling our story. To me the idea of financial well-being is this umbrella under which we can talk about and report on all of the great work we are doing.

As Todd said, his credit union has to be in tune with his members and the community. Every single credit union has to figure out what those needs are and how they can serve them in the community. What we’re really good at from an advocacy standpoint is meeting with a member of Congress and talking about what we’re doing at an individual level. But we’re not really very good at it from the collective level. How do we tell our story in the aggregate?